Earlier this month, Sunstone Management distributed approximately $1 million in Simple Agreements for Equity (SAFE) to 10 early-stage technology startups with the hope that these diverse entrepreneurs would become partners in the creative, complex, and challenging journey of risking it all to realize their entrepreneurial dream.

This activity—early-stage venture capital investing—is an incredibly unique and creative aspect of the American economy. Where else in the world are investors willing to risk their hard-earned money to support an early-stage entrepreneur—often for 10 years or more, on someone they have never met, and business idea they don’t really understand—with the hope of long-term success for both the investment partner and the founder.

According to the National Venture Capital Association (NVCA), 2020 was a record year (despite the onset of COVID-19 and the worst recession since the Great Depression), where over 10,000 venture-backed companies received an investment and high-growth startups raised more than $130 billion (NVCA 2021 Yearbook). This represents over 51 percent of the global venture capital investment—a stunning number when considering that America represented only 18.5 percent of world GDP in 2020, according to Trading Economics.

How Does Early-Stage Venture Capital Support the American Dream?

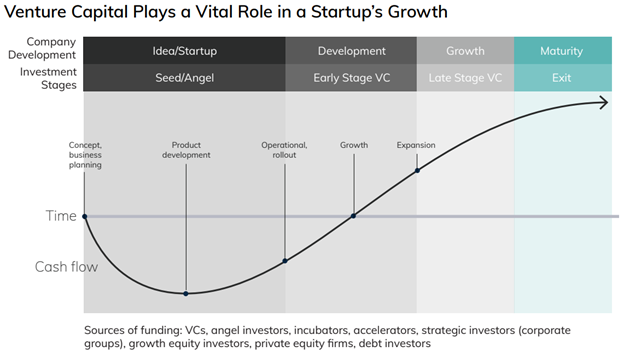

At Sunstone Management, we are Founder-Focused. This means that we invest in both capital as well as technical assistance to help our early-stage entrepreneurs—our Founders—to create great businesses, provide for their families, and grow job opportunities for their communities. Early-stage venture capital firms like Sunstone Management are partners in this process, summarized well in the following journey map from the NVCA 2021 Yearbook.

At Sunstone Management, we know that if our Founders succeed our Partners succeed and our definition of Partners includes our investors, accelerator operators, local governments, and educational partners—the entire ecosystem that supports small business development, economic growth, and makes the American Dream accessible to everyone.

More About Sunstone Management

Sunstone Management is a Founder-First early-stage venture capital investment firm located in Southern California dedicated to building great companies through creative public-private-education partnerships. If you believe in a similar investment philosophy, we encourage you to join the Sunstone Community today. We are always seeking great investors, entrepreneurs, and staff to advance our vision for the economy and the world around us. You can visit our website at sunstoneinvestment.com for more information or follow us on social media for upcoming events and announcements at LinkedIn, Twitter and Facebook.